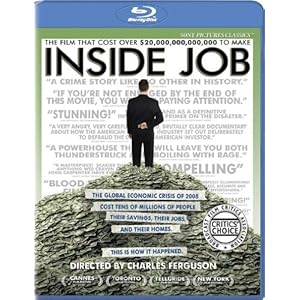

The subject of Inside Job is the global financial crisis of 2008. It features research and extensive interviews with financial insiders, politicians, journalists, and academics.

The film focuses on changes in the financial industry in the decade leading up to the crisis, the political movement toward deregulation, and how the development of complex trading such as the derivatives market allowed for large increases in risk taking that circumvented older regulations that were intended to control systemic risk. In describing the crisis as it unfolded, the film also looks at conflicts of interest in the financial sector, many of which it suggests are not properly disclosed. The film suggests that these conflicts of interest affected credit rating agencies as well as academics who receive funding as consultants but do not disclose this information in their academic writing, and that these conflicts played a role in obscuring and exacerbating the crisis.

A major theme is the pressure from the financial industry on the political process to avoid regulation, and the ways that it is exerted. One conflict discussed is the prevalence of the revolving door, whereby financial regulators can be hired within the financial sector upon leaving government and make millions.

Within the derivatives market, the film contends that the high risks that began with subprime lending were transferred from investors to other investors who, due to questionable rating practices, falsely believed that the investments were safe. Thus, lenders were pushed to sign up mortgages without regard to risk, or even favoring higher interest rate loans, since, once these mortgages were packaged together, the risk was disguised. According to the film, the resulting products would often have AAA ratings, equal to U.S. government bonds. The products could then be used even by investors such as retirement funds who are required to limit themselves to the safest investments.

Another issue discussed is the high pay in the financial industry, and how it has grown in recent decades out of proportion to the rest of the economy. Even at the banks that failed, the film shows how bank executives were making hundreds of millions of dollars in the period immediately up to the crisis, all of which was kept, again suggesting that the risk/benefit balance has been broken.

The film ends by contending that despite recent financial regulations, the underlying system has not changed; rather the remaining banks are only bigger, while all the incentives remain the same.

¡Bienvenido a mundodvd! Regístrate ahora y accede a todos los contenidos de la web. El registro es totalmente gratuito y obtendrás muchas ventajas.

¡Bienvenido a mundodvd! Regístrate ahora y accede a todos los contenidos de la web. El registro es totalmente gratuito y obtendrás muchas ventajas.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Citar

Citar